Quicken 2018 Update For Mac

Quicken will be the best known private finance software. Best is certainly it the best? We put it to the test in our Quicken 2018 Review. Here, we'll walk through the general benefits and cons of Quicken, who its greatest for, expenses, new features, add-ons ánd a walk-thróugh of functions for Quicken 2018.

Is usually one of the huge brands in the globe of individual finance, partly because it't been around for so lengthy. Quicken has been first launched in 1983. Its first version ran on 2! So it's sométhing of a dinósaur among budgeting ápps. With that stated, Quicken nevertheless offers a great deal going for it, though it't not the right financial administration device for everyone. Benefits and Cons of Quicken With a tool that's ended up about since the 80's, there's a lot to enjoy and a lot to detest. Quicken certainly offers its quirks, and it's not really a great match for everyone.

- I use Quicken for Mac 2018 and my last update was v5.4.0. I had to reconfigure my Mac and the latest release on Quicken's site is v5.3.2. Using v5.3.2, I cannot load my data file and Quicken tell me that I have the latest version (v5.3.2).

- Quicken 2018 Deluxe Serial Key manage all of your personal resources, check your spendings, compare all of them against your earnings and decide where you can help to make cuts.Quicken automatically sets up and categorizes your financial transactions and helps you pay the bills on time.It assists you to create your price range based on aims and on whatever you spent during the past.It is a.

I purchased Quicken 2018, and I am glad a own Parallels, as Quicken 2018 for mac does not come close to the windows versions I have used for years. I am looking at alternatives, as Quicken for PC is my only use for VM’s.

But it also has some great stuff that long-time users absolutely love. Right here's a quick checklist of benefits and cons to consider. Quicken Advantages.

Doesn't have got to synchronize straight with your lender. Free text editor for mac. If you put on't like the concept of a budgeting tool connecting straight with your loan provider accounts, Quicken doesn'capital t have to. But you can also manually get into dealings. Or you cán download a Quickén or CSV file of transactions from your bank or investment company.

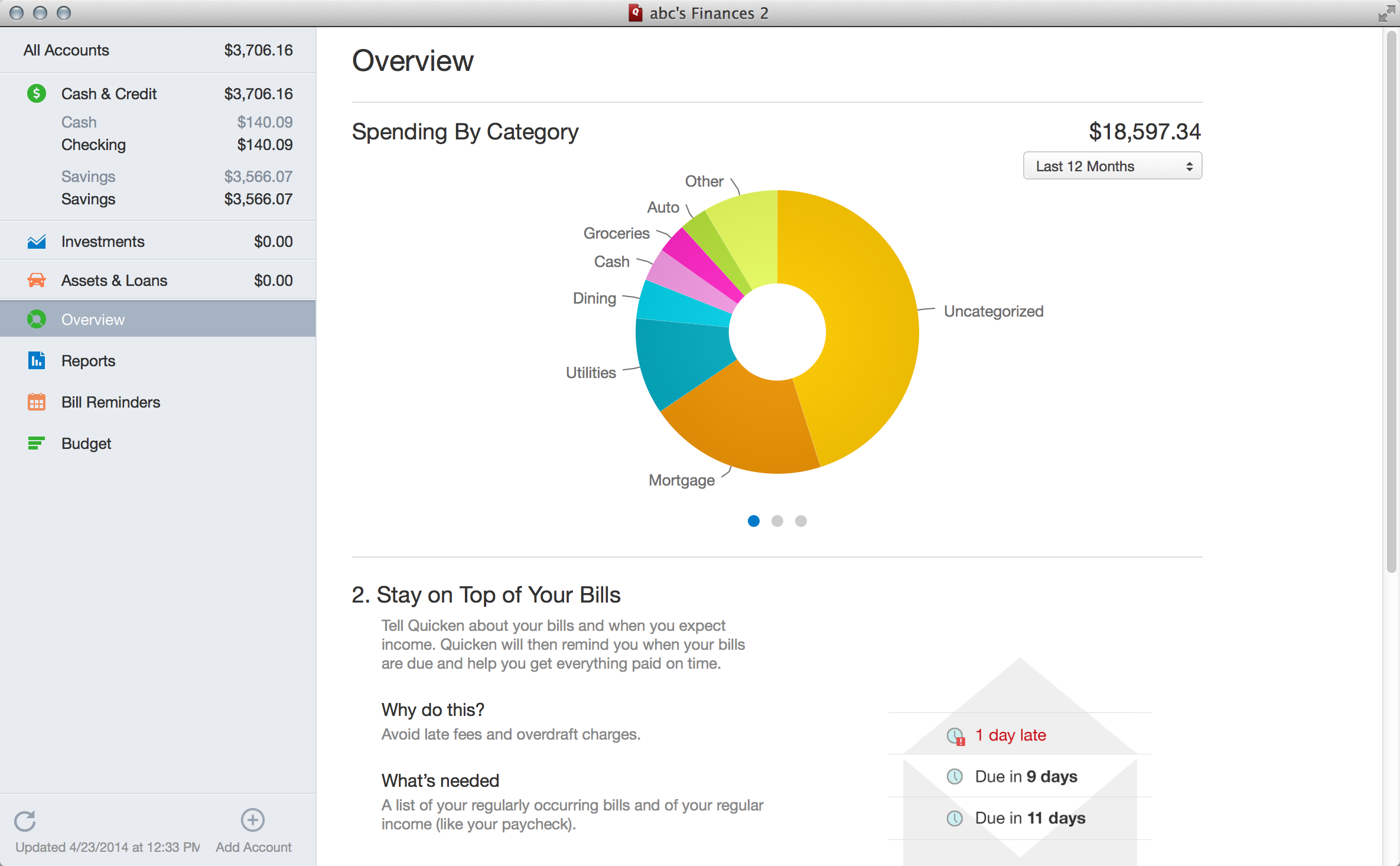

Then you can add them to Quicken in simply a few seconds. Easy-to-usé visuals. I put on't find Quicken'h visuals to end up being the most appealing in the entire world of budgeting tools. But they're not really terrible. You can obtain a fast breakdown of where you are usually on your regular budget groups, where you spend most of your cash, and more. Total control over both spending budget and investment data. Several other tools, such as Mint and Personal Capital, are usually more focused on either budgéting (Mint) or investing (Private Capital).

With the right edition of Quicken, you can obtain a strong management choice for both. Credit card debt reduction equipment built in. Quicken has built-in equipment for decreasing your debts. It will allow you task out the effect of additional debt payments, including how very much you'll conserve in interest. Bill tracking and pointers. You possibly already from many of your credit card and resources companies. But you can shift them all into the same user interface with Quicken.

It will furthermore help you find your bills when you fixed up your account. Projected balances based on upcoming expenses.

One of the cool stuff about placing in your expenses with Quicken is usually that it lets you amount out how much cash you will possess in the future, based on your forthcoming bills. Auto net worth monitoring.

If tracking your world wide web worth is certainly essential to you (ánd it!), Quicken can make it simple. You'll really get a world wide web worth calculation on the sidebar that changes any period you make modifications or import new transactions. Portable app with notifications. Quicken furthermore offers a mobile app. It'h not really the slickest oné in the bunch. But it will let you enter transactions and examine out your accounts on the move.

Quicken Negatives. Relatively high costs likened with some equipment.

Quicken is to Intuit't free device,. It's essentially a even more robust version. But it costs anywhere from $40 to $80+ per calendar year, depending on which version you purchase and whether or not you get a price cut. Doesn't sync with all banking institutions conveniently. I had trouble syncing Quickén with my Huntingtón Country wide Bank checking out account.

I've acquired trouble with Huntington with some other tools, simply because well, just for complete disclosure. But the issue with Quicken is usually that you have got to buy it before you can consider to synchronize it with an account.

So you may would like to dig around online to be certain it'll work with your loan company if syncing dealings is important to you. Can be frustrating to start using. Probably the biggest problem for new Quicken customers is sheer overwhelm. It contains a lot of different tools and details.

Obtaining it set up can get a even though, and learning to make use of it efficiently can get even longer. If you want a full image of your finances, this can become well worth your period. But if you just would like to invest ten mins a week monitoring your budget, it's possibly not really your best bet.

Not really as easy as some interfaces. Quicken offers always left something to end up being preferred with its interface, I believe. It'beds just not really as pretty or simply because intuitive as some spending budget tool interfaces. With that said, it's got much better since I very first started looking at it. It'beds cleaner and even more intuitive now than it utilized to be. Not accessible on the cloud. Probably the greatest disadvantage for me ás an on-thé-go MiIlennial with many different devices will be that Quicken provides to be set up on my computer.

So I can just fully gain access to it in one location, unless I set up the software on multiple computers. This can obtain frustrating. Frankly, I'd rather use a tool I can gain access to from anywhere with an internet link. With that said, it could be fine that you don't have got to end up being linked to the internet to carry out some jobs on Quicken.

Who is certainly Quicken For? Right now that you understand the simple benefits and cons of Quicken, you might currently have thought out whether or not really it't for you. But right here are usually some people I think might advantage almost all from Quicken.

Thé Detail-Oriented lf you really want visibility into every factor of your financial life just about all in one location, Quicken may become the greatest device for you. Yes, various other spending budget and have got similar functions. But several have got the available tools for debts payoff, stability projections, and long lasting setting up that Quicken gives. As a detail-oriented individual, you may end up being most likely to invest time searching into what Quicken provides. And this may make it worth your while.

Once you obtain your systems in place and start using this tool, it will offer you with details on the minutiá of your entire financial lifestyle. Business Proprietors Of program, Quicken is certainly nevertheless a go-to for business owners. Even larger businesses and nonprofits make use of their solid tools for handling the company spending budget. But I think it's the perfect device for little business owners and entrepreneurs. That's because it can concurrently monitor your business finances and your personal funds.

It'll maintain things split for yóu, but you cán use the exact same tool to do both. And that could save you period and headache in the lengthy term. Traders who Spending budget As I've stated before in this evaluation, many other tools focus on either trading or budgeting. Is certainly an fantastic device if you desire a detailed look at of your assets and a sky-level watch of your investing. You can definitely use it for a more detailed spending budget, but it's not built for that as much.

Mint, on the other hand, will track your opportunities. But it gives you a detailed budget and an overview of your opportunities. Quicken combines complete budgeting and detailed investing, therefore that you obtain both in one tool.

So if you're an investor but you also prefer to function with a comprehensive spending budget, Quicken might be the tool for you. Those With Protection Concerns Increasingly, budgeting and trading tools sync directly with loan company and investment accounts and store information in the fog up.

Quicken can end up being established up to perform neither. It can reside solely on your desktop. And you can pull in information personally or with downloaded transaction logs from your loan provider. If you're worried about the protection of additional systems, Quicken can give you the monetary management equipment you require while allaying somé of your protection problems. Quicken 2018 Features Quicken arrives out with a brand-new edition each calendar year.

You can upgrade your old version, or you can simply get began with the most recent version. Right here's what you'll discover with Quicken 2018. New Functions and Costs for 2018 One of the biggest can be Quicken's expanded Mac choices. For the initial time, Macintosh customers can choose between various products centered on what fits their requirements.

Overall, Quicken is intended to simply work better for Apple computers than it offers in the prior. Here are a couple of other brand-new features:. Regular membership Based Plan: Rather of purchasing an upgrade every season, Quicken associates pay out an annual fee and automatically get upgraded each time a brand-new version proceeds out. Online Payment Gain access to: Quicken right now integrates with more than 11,000 billers, and it allows you download PDF copies of your expenses correct to Quicken. You can also track and spend expenses from Quicken. Direct Review to Excel: If you desire to track your spending budget and monetary functionality over period in Excel, Quicken can now directly move reports to this system.

Better Purchase Evaluation: This feature is constantly being enhanced, and it's supposed to end up being even better for 2018. Dropbox Collaboration: All new users will obtain an extra 5GM of information from Dropbox to back up their Quicken information. Those are usually the brand-new and updated features you can anticipate with the most recent edition of Quicken. So what will it in fact look like and do? I brought in a few weeks' worth of dealings to give you a fast walk-through of the most recent interface. House The initial tab on your Quicken interface is usually the Home tab.

This gives you a quick summary of your current financial scenario. The great news is definitely that you can customize this display. You can show your spending first or prioritize your ventures. It'beds totally up to yóu. When you begin up Quicken, the home display screen will provide you different quick-start choices, as you'll find below. You can notice that Quicken wants me to set up my bills in the program. And as you're getting began, you can use the buiIt-in wizards tó stroll through these processes stage by stage.

The Customize key allows you select precisely what seems on your home screen and in what order: From the House screen and every various other display screen, you'll notice the menu bar on the best and one on the still left. The bar on the left contains your present net worthy of at the base.

Spending The second tab is where you'll proceed to track your investing. Quicken will immediately break straight down imported transactions into classes. But you can always recategorize dealings. You can also modify the groups here, based on how your spending budget breaks down.

Quicken 2018 Update

One of the wonderful issues about this display screen can be that you can appear at spending in various pieces. The drop-down selections at the top let you look at spending just from particular accounts, or from certain periods of time.

So you can discover what classes you invest on from your checking accounts versus your credit credit card, for instance. Maintain in thoughts that this data could become totally incorrect as it comes in. Quicken will alert you when there are uncategorized dealings. But you may need to double-check the categories of every deal as it imports. Sometimes Quicken simply guesses wrong, which can toss your proportions way away from. Bills and Income This will be probably the function I including greatest about Quicken versus various other budgeting choices.

You can synchronize it up with your billers, such as Verizon or ATT. It takes some period to synchronize up with all your expenses. But as soon as you do, Quicken will put them into a work schedule view. After that it'll inform you what your accounts balances should end up being centered on your upcoming bills. You can perform the exact same point with planned revenue. If you possess a salaried job with regular paychecks, tell the system when you'll obtain paid and how very much. Again, it uses this information to task out your account amounts.

If you'd rather, or if your expenses provider isn'capital t accessible, you can place in your bills by hand. I can, for instance, put in how much we need to pay out for daycare ánd when that't credited each month.

Again, these long term expenses will show up on your diary, and you'll obtain a forecasted account stability centered on your bills. I acquired to fiddle aróund with this user interface for a bit before I could figure out how to use it properly.

But as soon as you have it, syncing up your expenses shouldn't consider all that long. It'h simply a issue of producing sure you place them aIl in so thát your projected stability isn'testosterone levels too significantly off. As soon as you put the expenses in, you can indicate them simply because paid as they get paid off.

This will occur automatically if you'ré synced to thé biller. Financial Planning Quicken's sturdy financial preparation tool consists of several choices, like as budgeting, taxes planning, and extensive setting up. I dug intó the budgeting tool with Quicken. As with the relaxation of the software program, this wasn'capital t the nearly all intuitive budget constructor I've actually utilized. You have to first produce the budget and after that use the “Budget Actions” tabs to choose which types to include. But they provide a group of groups, so you can develop very a detailed budget.

Once you include the categories, you have got to modify them independently to change their quantities. It's i9000 really type of a discomfort.

But right here's something I do including: you can determine at the beginning of the 12 months how much to budget each 30 days for each category. If you like preparing way ahead, this is a great option. Not really many on the internet budgeting tools will allow you program an yearly budget or plan so much into the potential future. Quicken also contains on this tabs is Credit card debt Reduction finance calculator. This enables you maintain track of your present debt and make a strategy to spend them off. It assists you project out how much you require to pay towards your debt to get them compensated off, and it'll show you how much curiosity you can expect to pay out over time.

The Savings Goals tabs allows you to do the same thing except for savings. You can save for particular goals, such as an upcoming vacation or a fresh car.

This section is intended for short- and mid-term objectives. The expense tracking option is more for long lasting targets like pension and general financial freedom. Quicken also provides a Taxes Middle. You can input your tax info, and it will tell you your projected tax come back or fees due. You can furthermore assign costs to different tax groups. This is definitely helpful if you're a little business proprietor or if you run a part gig with tax-deductible costs. You can furthermore make use of it to monitor factors like non-profit contributions.

The Life time Planner tool can be, as you might think, a huge overview of your entire financial life. You have to very first answer various queries, and after that Quicken assists you project your budget out over yrs and years. It't a high-level device that can become helpful for getting some additional insight into your monetary lifetime. Add-Ons If you're already making use of Quicken, you should think about including on some of its additional services. The many worthwhile are usually most likely the bill paying providers. This assistance is free of charge for Leading and above customers, or it costs $9.95 per 30 days for others. It enables you pay out your expenses straight through Quicken.

This can just make remaining on top of your bills simpler. Other services to consider consist of Quicken's i9000 Social Security Optimizer and their premium assistance for Home windows customers. There may end up being other tools online that can change these, even though, so end up being sure you do your buying about. You can also purchase the Quicken WillMaker device through the system. I've examined this elsewhere and think it's a sensible service for those with basic wills.

Various other Features Possibly the very best newer feature for Quicken is definitely the capability to set up cellular balances and get alerts. You can established up alerts for different account adjustments or forthcoming bills, for example. Most loan provider and expenditure accounts these times also allow you established up alerts.

But putting them all in one place might become useful as you manage your economic life. And, of course, provides plenty of documentation and lessons. It's oné of the Iongest-running financial management equipment about. So you'd expect it to possess plenty to state about how to take care of your funds. In the “Tips Tutorials” section, you can get information on Quicken, specifically, or broader info on obtaining out personal debt, setting savings objectives, and even more. Not sure if Quicken will be right for you? Check out out these.

Jack Feder I have used this product for a couple of years. They have added features, but changed the features a little. I can not change as my information is certainly captive, but after a latest update, there were a few corruptions to my DATA! The opening balances had been changed by the upgrade process. This can be not suitable and I just found out abóut it when l could simply no longer cash my accounts.

Accounting software program the corrupts information is less than worthless. Also, when I experienced problems with the automated connection functions, support squandered a day time by being useless, informing me I had to reinstall éverything etc. In thé end, after escalation, it flipped out they said they got trouble communication with some organizations, but they did not even notify their assistance people and the set up wizard is usually poorly written so you can't say to.

Today, I am attempting to established up the upgraded version so that it can print out cheques. Perform you know that in the file format if you select “empty collection before payee” that it simply no longer designs the adress óf the payee? lf you get free of the empty line, the adress designs, actually though the adress is definitely just 3 ranges and does not fill up up the package.

Based upon my previous dealings with their tech support, I received't also bother informing the. I can't waste materials the day. It is usually better just to warn people about this product. Steve Antonoff l've been making use of Quicken for almost 30 decades (Quicken for 2 beginning in 1989, before Home windows).

My routine, up until right now, has been to enhance every other 12 months since financial organization interfaces lasted for 3 decades with each upgrade. I'meters heading to wait around until 2019 arrives out before I update, and after that I'm going to get a appearance at some other applications before I devote to an annual buy for an untrustworthy item.

To me, the biggest issue with Quicken is definitely the “fragile” information base. I admit I haven't cleaned out out my Quicken file in about 12 decades today (balances have data going back again to 2006) so I'm most likely stressing the file even more than I shouId. But a completely functional financial plan should make use of an SQL data source with fresh dining tables for each season (or financial yr).

An yearly closeout, that shuts the prior year and starts a brand-new one, should take place instantly on the first access for the new (fiscal) year. I had a scenario recently where I withdréw a large portion of money from a Cost savings Goal. The disengagement from the goal proved helpful but Quicken must possess crashed before it place the money into the originating account, causing me $thousands brief of money until I discovered the error. Lately (beginning in Come july 1st), Quicken began copying some downloaded transactions in several accounts: I possess 4 accounts with my investment decision broker and when a dividend was received in 1 account, Quicken put it in 2 others, actually though those accounts didn't possess any of the stock that had been paying out the dividend.

I uncovered this in September through a reconcile procedure that wouldn't stability: Quicken acquired $hundreds of “bogus” transactions that got to be manually erased. I don't know if this was the mistake of Quicken or the monetary institution. I right now verify my Quicken document at least monthly to discover and get rid of errors.

MENLO PARK, Calif.-( )-Continuing the energy since becoming a standalone business, Quicken Inc. Announces its 2018 releases of Quicken for Windows and Mac users. With the up to date product collection, both choices provide on the business's commitment to stimulating Quicken. They include improved on-line bill administration, new investment decision functions, and simpler updates with Quicken's i9000 membership system, which provides automatic gain access to to the most recent variations. From staying on top of funds to managing assets, the 2018 produces of Quicken assist customers manage their finances at every phase of living. Expanded Macintosh capabilities For the first time actually, Mac customers now have gain access to to a option of items, like Quicken Beginner, Quicken Deluxe, and Quicken Premier.

This provides Mac customers more versatility to choose the giving that greatest fits their specific financial requirements. Quicken for Mac now contains all-new gain access to to online bills from even more than 11,000 billers, which are usually incorporated into a efficient bill workflow; expanded investment abilities with particular lot tracking and a extremely customizable collection see; and fresh loan tracking features like “what-if” mortgage evaluation. New features for Home windows Windows users now have got improved access to online expenses from even more than 11,000 billers, like PDF costs download and a streamlined expenses and transaction dashboard; brand-new report format and customization options; direct record export to Excel spreadsheet; improved investment performance evaluation (for Premier and above); and simple emailing of invoices and rental simple guidelines in House, Business Local rental Property Manager, with additional invoicing options such as internet links.

“We are always hearing to consumer responses and the 2018 releases of Quicken reveal the stability of brand-new functions and refinements to existing features that we understand our users desire,” stated Eric Dunn, key executive official of Quicken. “With our latest products, Macintosh offerings are more powerful, our interfaces are more intuitive, and our new membership program guarantees that clients always have got the latest and biggest Quicken without the pain of manually updating.” New membership rights program Quicken is now marketed on a a regular membership basis. Instead than buy updates every calendar year, customers immediately carry on to get the latest version of Quicken simply because very long as they keep their membership rights.

To copy files and directories use the cp command under a Linux, UNIX-like, and BSD like operating systems. Cp is the command entered in a Unix and Linux shell to copy a file from one place to another, possibly on a different filesystem. The cp is a Linux command for copying files and directories. The syntax is as follows. I can copy a folder to remote machine called server1.cyberciti.biz. Right, and advertising revenues are not sufficient to cover my operating costs. So you can see why I need to ask for your help. The nixCraft takes a lot of my time and hard work to. Provide multiple ways for copying files in a folder from a linux machine to your local mac machine..

Quicken offers both one- ór two-year memberships (two-year primarily available only at retail) to clients. In inclusion, Leading and House, Business Local rental Property Manager people will get free Quicken Expenses Pay and access to Quicken't Premium Treatment. Dropbox, Yelp and PayPal relationships Customers of all new versions of Quicken will receive an additional 5GT of Dropbox storage space for backup and collection of your Quicken data through our exceptional relationship with the leading cloud storage provider. Additionally, Quicken House, Business Local rental Property Manager customers can today produce and effortlessly email invoices with custom made trademarks and colors, along with links to their Yelp user profile, obligations (PayPal), and more. Mac how to add memorized text snippet for use in mail.

Prices and accessibility The 2018 discharge of Quicken is definitely available now at and at go for retailers like Amazon, Staples, and even more. Quicken Starter (Mac pc Home windows): Find where your cash is going therefore that you can achieve your short-term financial goals. One-year pub: $34.99. Two-year regular membership: $49.99 (available at retail). Quicken Deluxe (Macintosh Windows): Do even more with your cash. Consider the next phase toward your economic goals.

One-year membership rights: $49.99. Two-year a regular membership: $79.99 (available at retail). Quicken Premier (Mac Windows): Maximize your assets by improving portfolio performance and minimizing fees. One-year a regular membership: $74.99. Two-year regular membership: $119.99 (available at retail). Quicken Home, Business Rental Residence (Home windows): Manage your private and company funds in one place.

One-year membership rights: $99.99. Two-year regular membership: $149.99 (available at retail) About Quicken For even more than 30 yrs, Quicken, the top personal money management software program, has become the reliable financial solution for large numbers of customers.

Based in Menlo Park, California, Quicken Inc. Remains deeply dedicated to helping people and family members lead healthful financial existence.

The Quicken item line contains options for Mac pc and Windows users, simply because properly as a cellular app (Android and iOS) that give customers anytime, anywhere access to their finances. Effective March 31, 2016, Quicken started operating independently from Intuit Inc. Even more details can be discovered at.